[ad_1]

With the winter break now finally behind us, it’s time to talk mortgage rates again.

Lately, they’ve been on the minds of anyone even remotely interested in buying a home.

Or selling a home for that matter, as that can affect home buyer demand as well.

The good news is most forecasts are calling for lower mortgage rates throughout 2024.

And now there’s another piece of favorable data from Fannie Mae regarding mortgage rates and consumer sentiment.

Survey-High 31% of Consumers Expect Mortgage Rates to Fall This Year

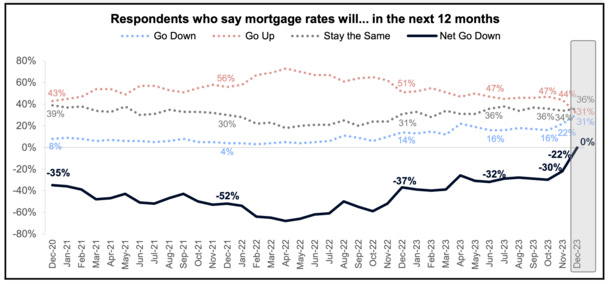

A report released this morning by Fannie Mae revealed that a survey-high 31% of consumers expect mortgage rates to decrease over the next 12 months.

Their so-called Home Purchase Sentiment Index (HPSI) reflects both consumers’ existing views and their future expectations for the housing market.

One of the more intriguing questions asked has to do with the expected direction of mortgage rates.

And in the latest survey, a record 31% of respondents said they believe mortgage rates will fall over the next 12 months.

While 31% may not sound like a lot, consider this share was around 16% in October, and just 4% in December 2021.

In other words, sentiment has shifted big time, with mortgage rate expectations doing a veritable 180.

Simply put, consumers no longer expect mortgage rates to rise, but rather they see them drifting lower after peaking last fall.

This is important for the housing market, which suffered mightily in 2023 as transactions plummeted in the face of 8% mortgage rates.

But with the expectation that the worst is now behind us and a return to rates in the 5% range (or even 4% range) is possible, it could reinvigorate home sales.

Aside from boosting affordability, simply due to a lower monthly housing payment, it could get some prospective buyers off the fence if they believe better times lie ahead.

Granted, not everyone is convinced.

Nearly a Third Still Think Mortgage Rates Will Move Higher This Year

Despite consumer optimism on mortgage rates hitting a new survey-high, 31% of respondents remain unconvinced.

Yes, the same percentage that think they’ll go down also think they’ll go up.

So it’s a bit of a standoff at the moment, though this pessimistic group has shrunk considerably.

In the prior survey, 44% of respondents expected mortgage rates to increase. And this share hovered around 50% for much of 2023.

It appeared to peak at 60% in mid-2022 and has since steadily fallen. Again, this could signal that the worst is behind us regarding high mortgage rates.

But it doesn’t mean they’ll drop back to their record lows, or anywhere near it.

The remaining 36% of respondents believe rates will simply stay put where they are over the next 12 months.

At last glance, this means a 30-year fixed mortgage rate somewhere between 6.5% to 6.75%.

While it’s not necessarily a low rate, it’s not as bad as it once was. And that alone could be somewhat of a game changer.

Look for Mortgage Rates to Experience Volatility in 2024

As noted in my 2024 mortgage rate predictions post, I believe interest rates will experience a bumpy ride as the year plays out.

However, I do expect rates to trend significantly lower and end the year just below 6%.

These ups and downs aren’t unique to 2024, but things could be even more volatile than usual given the contentious presidential election on the horizon.

And an economy that continues to surprise us, making the Fed’s inflation flight a little more complicated than it appears.

While the Fed is still expected to cut its federal funds rate several times this year, which should lead to lower consumer mortgage rates, it likely won’t be linear.

There will be good months and bad months, and times when rates rise more than they fall. It will mostly depend on the data, whether it’s CPI or the jobs report.

And as always, curveballs like geopolitical events, or simply politics in general, could also play a major role.

2024 Home Price Expectations Worsening Despite Lower Interest Rates

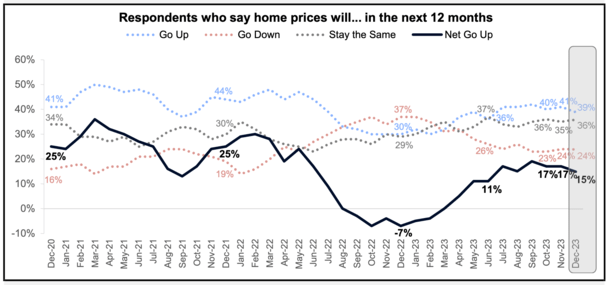

Lastly, despite a big improvement in mortgage rate sentiment, home price expectations took a turn for the worse.

While it’s logical to believe that mortgage rates and home prices have an inverse relationship, the data doesn’t support it.

Home prices and mortgage rates can fall together, go up together (as they did in 2022 and 2023), or go in opposite directions.

But there’s no clear correlation and just because rates are expected to fall in 2024 doesn’t mean home prices will surge again.

In fact, more of the same consumers surveyed by Fannie Mae expect home prices to go down over the next 12 months.

Just 39% of consumers expect home prices to go up in 2024, while 24% expect prices to go down, and 36% expect them to stay the same.

This means the net share of consumers who believe home prices will go up fell two percentage points to 15%.

So there’s still a lot of uncertainty, despite some recent positive developments. But perhaps if mortgage rates continue to drift lower, sentiment will improve.

Of course, if rates fall due to a recession or similar economic strife, fewer will believe it’s a good time to buy a home.

Speaking of, a whopping 83% believe it’s a bad time to buy a home while only 17% believe it’s a good time to do so.

[ad_2]

Source link