[ad_1]

It’s time for another mortgage match-up: “Cash out vs. HELOC vs. home equity loan.”

Yes, this is a three-way battle, unlike the typical two-way duels found in my ongoing series. Let’s discuss these options with the help of a real-life story involving a buddy of mine.

Now that mortgage rates are closer to 7% than they are 3%, there’s little reason for existing homeowners to refinance.

After all, if you were lucky enough to lock in a fixed mortgage rate in the 2-4% range, why would you exchange it for a rate nearly double that?

Chances are you wouldn’t, which explains why second mortgages like home equity loans and HELOCs have surged in popularity.

Let’s take a closer look at popular home equity extraction options to see which may be the best fit for your situation.

Perhaps the biggest consideration will be your existing mortgage rate, which you’ll either want to desperately keep or be happy to give away.

Cash Out Your First Mortgage or Take Out a HELOC/Home Equity Loan Instead?

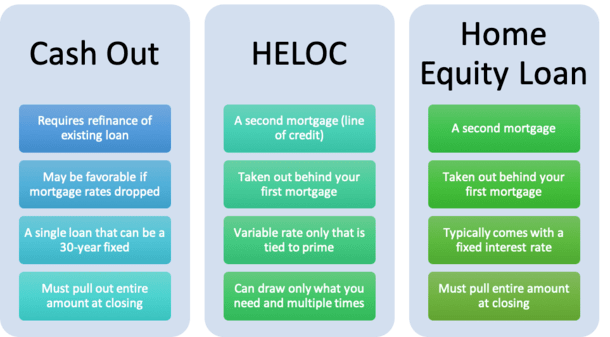

- If you have a mortgage and need cash, you’ve got two main options to access home equity

- You can refinance your first mortgage and take cash out on top of the existing balance

- Or you can take out a second mortgage to avoid disrupting the rate/term on the first mortgage

- This can be in the form of a variable-rate HELOC or a fixed-rate home equity loan

A couple years ago, a friend told me he was refinancing his first mortgage and taking cash out to complete some minor renovations.

I asked how much cash he was getting and he said something like $30,000.

Here in Los Angeles, $30,000 isn’t what I’d call a large amount of cash out. It might be in other parts of the country, or it may not.

Regardless, it wasn’t a lot of money relative to his outstanding mortgage balance.

I believe his mortgage balance was close to $500,000, so adding $30,000 was pretty minimal.

Anyway, I asked him if he had considered a HELOC or home equity loan as well. He said he hadn’t, and that his loan officer recommended refinancing his first mortgage and pulling out cash.

For the record, a loan officer may always point you towards the cash out refinance (if it makes sense to do so).

Why? Because it works out to a larger commission since it’s based on the full loan amount. We’re talking $530,000 vs. $30,000.

Now the reason I bring up the amount of cash out is the fact that it’s not a lot of money to tap while refinancing a near jumbo mortgage.

My buddy could just as well have gone to a bank and asked for a line of credit for $30,000, or even applied online for a home equity loan of a similar amount.

Heck, maybe even a 0% APR credit card would have worked for minor home renovations.

The upside to these alternatives is that there aren’t many closing costs associated (if any), and you don’t disrupt your first mortgage.

Conversely, a cash out refinance has the typical closing costs found on any other first mortgage, including things like lender fees, origination fee, appraisal, title insurance and escrow, etc.

In other words, the cash out refi can cost several thousand dollars, whereas the home equity line/loan options may only come with a flat fee of a few hundred bucks, or even zero closing costs.

Nobody Wants to Give Up Their Low-Rate Mortgage Right Now

Now that story was from a few years ago, when the 30-year fixed averaged between 3-4%. Today, it’s a completely different situation, as you’re probably aware.

It turned out that my pal had a 30-year fixed rate somewhere in the 5% range, and was able to get it down around 4% with his cash out refinance, a win-win.

The mortgage was also relatively new, so most payments still went toward interest and resetting the clock wasn’t really an issue.

For him, it was a no-brainer to just go ahead and refinance his first mortgage.

When everything was said and done, his monthly payment actually dropped because his new interest rate was that much lower, despite the larger loan amount tied to the cash out.

But for someone to recommend a cash out refinance today, the borrower would need to have a pretty high mortgage rate.

After all, if they’re facing a new mortgage rate in the 7-8% range, depending on loan specifics, they’d need to have something comparable already. Or perhaps a small outstanding loan balance.

As noted, exchanging a low rate for a high rate typically isn’t the best move. There may be cases, but generally this is to be avoided.

When mortgage rates are high, as they are now (at least relative to recent years), exploring a second mortgage might be the better move.

A Second Mortgage Allows You to Keep Your First Mortgage Untouched, But Still Get Cash

That brings us to the first advantage of a second mortgage such as a HELOC or home equity loan; it allows you to keep your first mortgage.

So if you have that 30-year fixed set at 2% or 3%, and you don’t want to lose it, going the second mortgage route might be the best way to tap your equity if you need cash.

It’s unclear if we’ll see interest rates that low anytime soon, or perhaps ever again. If you’ve got one, you probably want to keep it. And I don’t blame you.

Or perhaps your existing loan is close to being paid off, with most payments going toward principal.

In that case, you may not want to mess with it late in the game. Maybe you’re close to retirement and don’t want to restart the clock.

Adding cash out to a first mortgage could also potentially raise the loan-to-value ratio (LTV) to a point where there are more pricing adjustments associated with your loan. Also not good.

Conversely, a second mortgage via a HELOC or home equity loan allows you to tap your equity without disrupting your first mortgage.

This can be beneficial for the reasons I just mentioned, especially in a rising rate environment like we’re experiencing now.

Now this potential pro may not actually be an advantage if the mortgage rate on your first mortgage is unfavorable, or simply can be improved via a refinance. But right now, this likely isn’t the case.

HELOCs and Home Equity Loans Have Low or No Closing Costs

- Both second mortgage loan options come with low or no closing costs

- This can make them a good option for the cash-strapped borrower

- And the loan process might be faster and easier to get through

- But the interest rate on the loans may be higher at the outset or adjustable

Another perk to second mortgages is lower closing costs. Or even no closing costs.

For example, Discover Home Loans doesn’t charge any lender fees or third party fees on its home equity loans. Similar deals can be had with other banks/lenders on second mortgages if you shop around.

You may also be able to avoid an appraisal if you keep the combined-loan-to-value (CLTV) at/below 80% and the loan amount below a certain threshold.

Just be sure to pay attention to the interest rate offered. Similar to a no cost refinance, a lack of fees are only helpful if the interest rate is competitive. Sometimes the tradeoff is a higher rate.

It should also be relatively easier to apply for and get a second mortgage versus a cash out refinance.

Generally, the loan process is shorter (perhaps just a week to 10 days) and less paperwork intensive.

So you might find some more convenience and fewer closing costs when going with a second mortgage.

HELOCs Are Variable and Have Increased in Price a Lot

- HELOC rates are tied to the prime rate and change whenever the Fed hikes/lowers rates

- The Fed hiked rates 11 times since early 2022 (pushing prime from 3.25% to 8.50%)

- This meant those with HELOCs saw their interest rates rise 525 basis points (5.25%)

- The good news is they may come down again if the Fed begins cutting rates soon

The main downside to a HELOC is the variable interest rate, which is tied to the prime rate.

Whenever the Fed raises its own fed funds rate, the prime rate goes up by the same amount.

Since early 2022, the Fed has increased rates 11 times, or a total of 525 basis points (bps).

For example, someone with a HELOC that was originally set at 5% now has a rate of 10.25%. Ouch!

Fortunately, HELOCs tend to have lower loan amounts than first mortgages, meaning they can be paid off more quickly if rates really jump.

Additionally, HELOCs use the average daily balance to calculate interest, so any payments made during a given month will make an immediate impact.

This differs from traditional mortgages that are calculated monthly, meaning paying early in the month will do nothing to reduce interest owed.

A HELOC also gives you the option to make interest-only payments, and borrow only what you need on the line you apply for.

This provides extra flexibility over simply taking out a loan via the cash out refi or HEL, which requires the full lump sum to be borrowed at the outset.

And there’s hope that the Fed will begin cutting rates this year, which should provide some relief for existing HELOC holders.

Home Equity Loans Are Often Fixed-Rate But Require Lump Sum Payouts

If you don’t want to worry about your interest rate increasing, you can choose a home equity loan (HEL) instead.

These are typically offered with a fixed rate, though it might be priced above the start rate on the HELOC.

Still, the HEL option gives you the certainty of a fixed interest rate, a relatively low rate, and options to pay it back very quickly, with terms as short as 60 months.

For someone who needs money, but doesn’t want to pay a lot of interest (and can pay it back pretty quickly), a HEL could be a good, low-cost choice if they’re happy with their first mortgage.

One downside to a home equity loan is you are required to pull out the full loan amount at closing.

This differs from a HELOC, which acts more like a credit card that you can borrow from only if you need it.

So you’d really only want the home equity loan if you needed all the cash immediately.

Ultimately, the decision between these options will be driven by your existing mortgage rate, current interest rates, how long you’ve had your loan, and your cash needs.

Every situation is different, but I’ve listed of the pros and cons of each option. Here is a list of the potential advantages and disadvantages for the sake of simplicity.

Pros and Cons of a Cash Out Refinance

The Pros

- You only have one mortgage (and monthly payment) to worry about

- Can lower the interest rate on your first mortgage if rates are favorable

- And get the cash you need at the same time (single transaction)

- More loan options available like a fixed-rate loan or an ARM

- Interest may be tax deductible

- Offered by more banks and lenders vs. second mortgages

The Cons

- Increases your loan amount (and likely your monthly payment too)

- Higher closing costs versus second mortgages

- A potentially more difficult (and lengthy) loan process

- Your first mortgage restarts (could be a negative if it’s nearly paid off)

- Interest rate may increase with a higher LTV ratio

- May have to limit loan size to avoid PMI or jumbo loan territory

Pros and Cons of a HELOC

The Pros

- Don’t disrupt your first mortgage rate or loan term (get to keep it if it’s low!)

- Easier and faster loan process

- Relatively low interest rates (might offer promo rate first year such as prime + 0.99%)

- Low or no closing costs (may not need an appraisal)

- Ability to make interest-only payments

- Only use what you need, can be a lifeline reserved only if/when needed

- Can reuse the line if you pay it back during the draw period of the loan term

- Potential tax deduction

- Good for someone who is happy with their first mortgage

The Cons

- Variable rate tied to Prime (may increase or decrease as Fed moves rates)

- Eventually have to make fully-amortized payments (could be payment shock)

- Bank can cut/freeze the line amount if the economy/housing market tanks

- May charge a fee for early closure if paid off in first few years

- Have to manage two loans instead of one

Pros and Cons of a Home Equity Loan (HEL)

The Pros

- Don’t disrupt your first mortgage rate or loan term (get to keep it if it’s low!)

- The interest rate is fixed and should be a lowish rate (but typically higher than HELOCs)

- Loan terms as short as 60 months or as long as 20 years

- Can pay less interest with a shorter loan term

- No or low closing costs (may not need an appraisal)

- Easier and faster loan process

- Potential tax write-off

The Cons

- Must borrow entire amount upfront, even if you don’t need it all right away (or ever)

- Origination fee typically charged on total lump sum borrowed

- Have to manage two loans instead of just one

- Rates may not be as favorable as a first mortgage or HELOC

- Closing costs might be higher compared to a HELOC

- Monthly payments might be more expensive with higher rate and/or shorter term

[ad_2]

Source link